If You Could Redesign Your Benefits Today, Would You Still Ignore ICHRA in 2026?

If You Could Redesign Your Benefits Today, Would You Still Ignore ICHRA in 2026?

The uncomfortable question: What would you choose if you weren’t chained to legacy health plans?

Table of Contents

Definition

Analogy Quote

Video

Historical Story

Bridge Paragraph

Modern Explanation

The Clean-Slate Benefits Framework

Contrarian Insight

Action Steps

FAQs

Call to Action

Sources

Definition

An ICHRA (Individual Coverage Health Reimbursement Arrangement) is an employer-funded health benefit that reimburses employees tax-free for individual health insurance premiums and eligible medical expenses. It allows employers to set fixed budgets while employees choose coverage that fits their lives. In 2026, ICHRA represents a shift from group plan dependency to employee-driven health design.

Analogy Quote

You don’t redesign the future using yesterday’s blueprints.

Historical Story

In the early 20th century, cities were built around railroads. Entire economies followed the tracks—factories, housing, labor. It made sense then. The rails were the backbone of progress.

But when automobiles emerged, something strange happened. Cities didn’t redesign themselves overnight. They kept widening roads around old rail hubs, patching inefficiencies instead of rethinking mobility itself. Congestion grew. Costs exploded. Progress slowed.

Eventually, planners asked an uncomfortable question: If we were designing this city today, would we still build it this way?

That question separated modern cities from stagnant ones. Those who redesigned from scratch thrived. Those who clung to legacy layouts paid the price for decades.

alt: A modern city redesigned with flexibility and choice

concept_prompt: Cinematic illustration of a city rebuilt from scratch, emphasizing flexibility and modern systems

placeholder_url: {{HERO_IMAGE_URL}}

alt: Employees selecting individual health plans

concept_prompt: Diverse employees choosing personalized health coverage on digital devices

placeholder_url: {{IMAGE_2_URL}}

Bridge Paragraph

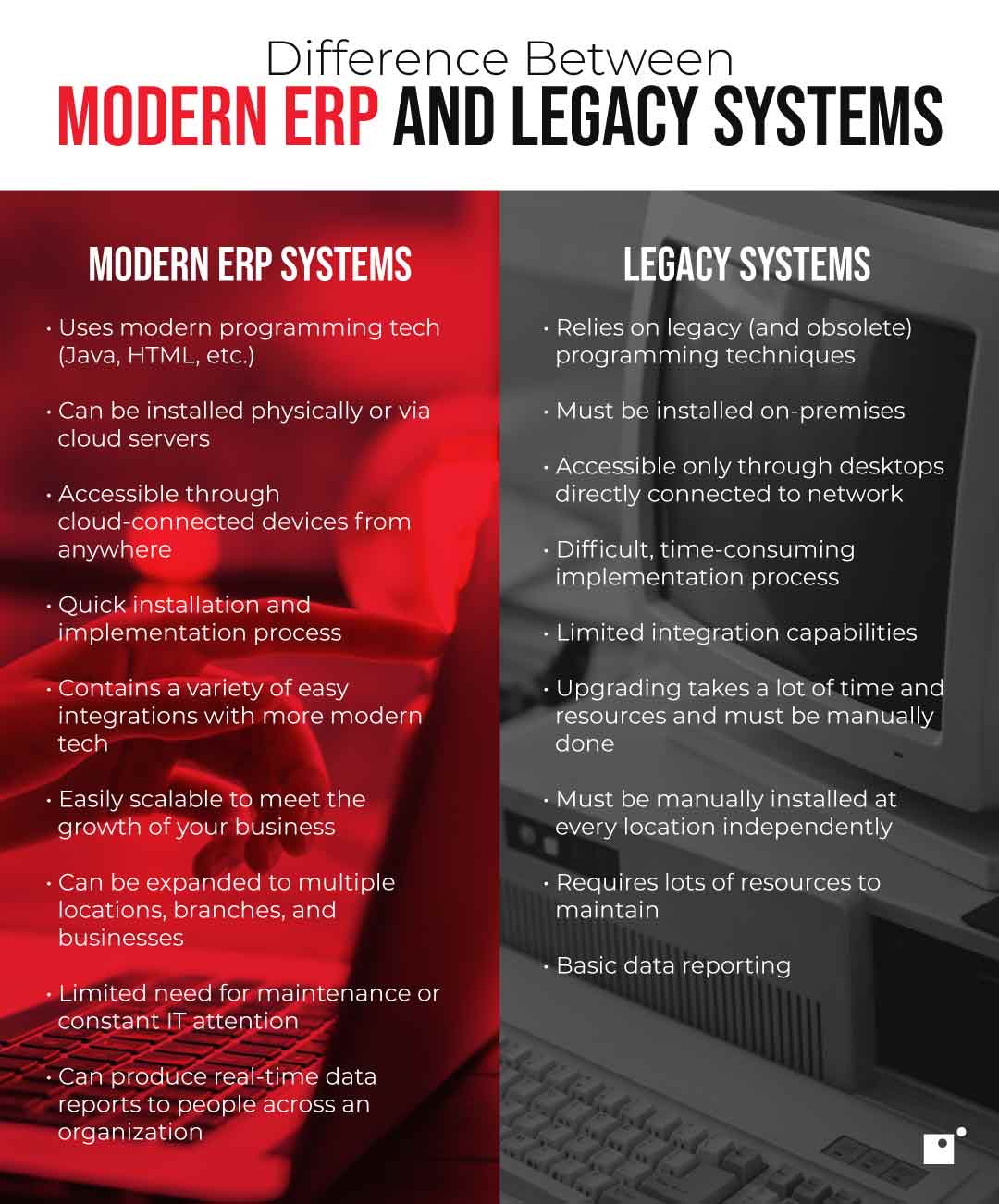

Employer-sponsored health benefits are today’s railroad cities. Group health plans weren’t designed for flexibility, remote work, or workforce diversity—but most employers still build around them. ICHRA asks the same disruptive question city planners once did: If you were starting today, would you design it this way?

Modern Explanation

In 2026, employers face rising premiums, unpredictable renewals, and employees who want choice—not one-size-fits-all plans. Traditional group health insurance ties employers to carrier negotiations, participation rules, and annual volatility.

ICHRA flips the model. Employers define their budget. Employees choose their plan on the individual market—often with more options, broader networks, and personalized coverage. Compliance is structured, scalable, and class-based, allowing different employee groups to receive tailored benefits.

Poor administration turns ICHRA into confusion: missed notices, incorrect reimbursements, employee distrust. Strong administration—automated, compliant, human-supported—turns it into a competitive advantage.

The Clean-Slate Benefits Framework

A redesign-first approach inspired by cities that modernized:

1️⃣ Erase Legacy Assumptions

Stop asking how to “fix” your group plan. Ask what problem you’re solving.

2️⃣ Set Clear Boundaries

Define predictable employer budgets instead of absorbing unlimited premium risk.

3️⃣ Empower Individual Choice

Let employees choose coverage aligned to their health, family, and geography.

4️⃣ Automate Compliance

Use technology to handle notices, substantiation, and reimbursements accurately.

5️⃣ Humanize the Experience

Support employees through education, onboarding, and real-time assistance.

Contrarian Insight

Most employers believe ICHRA is risky, complex, or “not ready,” but the truth is the risk lies in staying frozen. Group plans feel familiar, yet they hide volatility, employee dissatisfaction, and administrative drag. Modernizing with ICHRA isn’t radical—it’s overdue.

Action Steps

Run a Clean-Slate Evaluation

Ignore your current plan and model benefits as if you were launching today.Segment Your Workforce

Identify which employee classes would benefit most from ICHRA flexibility.Stress-Test Compliance

Ensure notices, affordability, and substantiation are handled correctly.Modernize Administration

Partner with a TPA like CaféHealth for AI-powered accuracy and faster reimbursements.Educate Before You Launch

Clear employee communication turns skepticism into confidence.

FAQs

What is ICHRA and why consider it in 2026?

ICHRA allows employers to reimburse individual health coverage, offering cost control, flexibility, and employee choice in a modern workforce.

Is ICHRA compliant with IRS and ACA rules?

Yes, when properly administered with required notices, affordability testing, and documentation.

Can ICHRA replace group health insurance entirely?

Yes. Many employers fully replace group plans, while others use ICHRA for specific classes.

Do employees like ICHRA?

When supported and explained well, employees value choice and personalized coverage.

Is ICHRA only for large employers?

No. Employers of all sizes can adopt ICHRA.

What happens if ICHRA is administered poorly?

Errors can trigger compliance risks and employee frustration—administration quality is critical.

Call to Action

See how CaféHealth improves accuracy, compliance, and employee experience with AI-powered benefits administration. Start here: CafeHealth.com.